Back to Industry News

General

Medtech Magazine: Sweden Tightens Bid Rules; First Brands Group Files Bankruptcy

Summary generated with AI, editor-reviewed

Heartspace News Desk

•Source: Medtech Magazine, Bloomberg.com

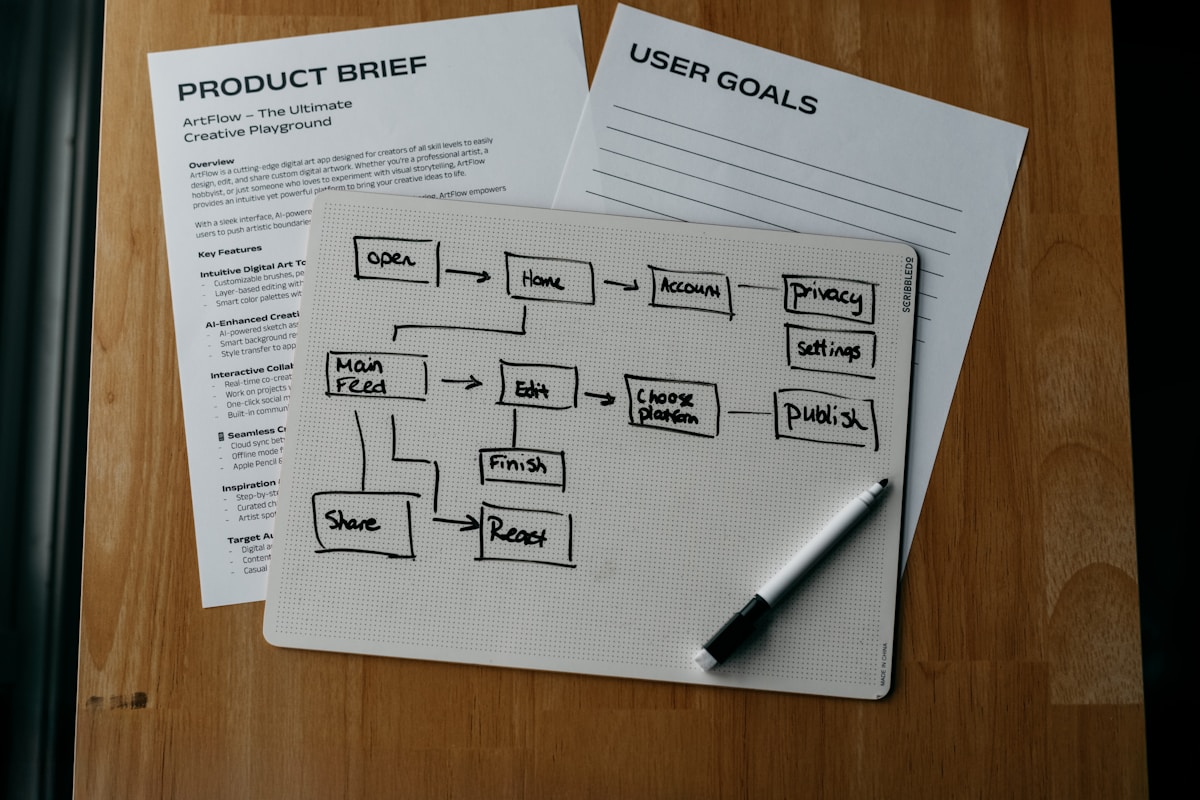

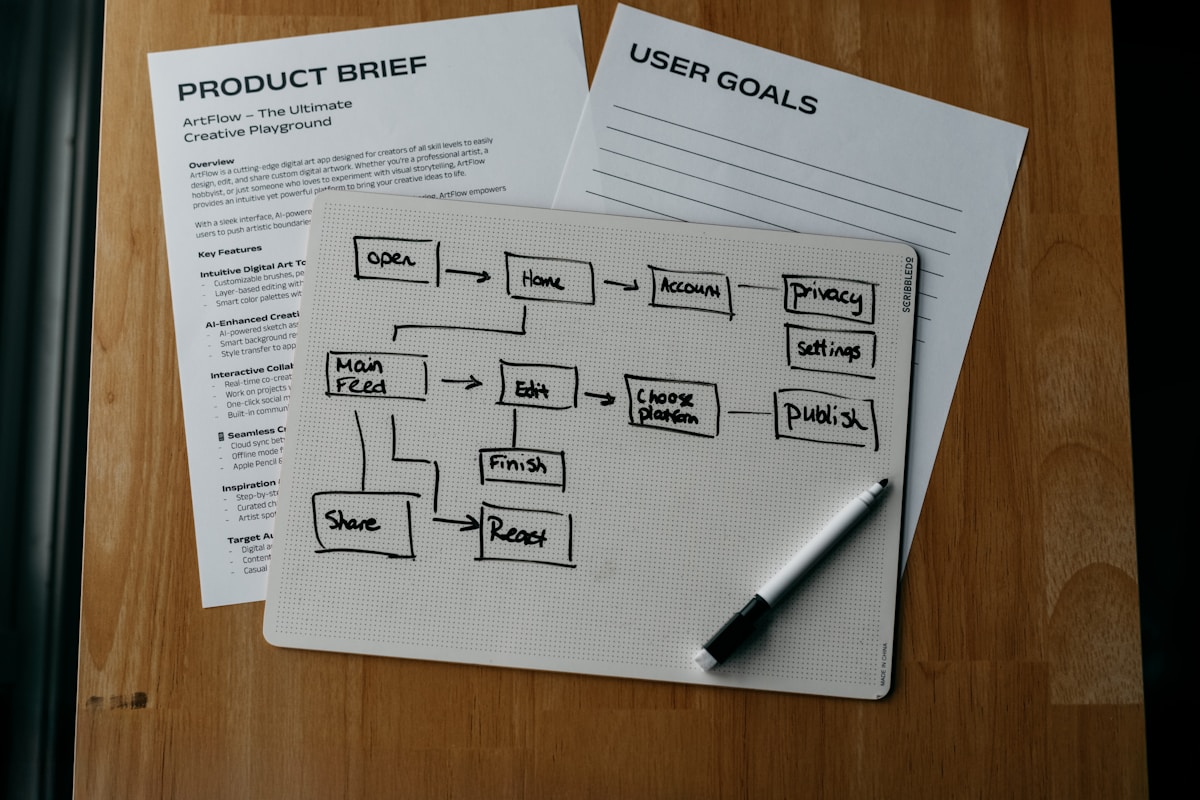

Photo by Kelly Sikkema on Unsplash

Stay updated on stories like this

Key takeaways

- On October 2, 2025, *Medtech Magazine* reported on the Swedish Competition Authority's (Konkurrensverket) initial findings regarding abnormally low bids in public procurement

- The report analyzes current measures and proposes new legal frameworks to enhance competition and mitigate risks associated with unreliable suppliers

- The Konkurrensverket suggests that existing regulations, including LOU, LUF, and LUFS, are inadequate in preventing unfair competition and potential criminal activities

On October 2, 2025, *Medtech Magazine* reported on the Swedish Competition Authority's (Konkurrensverket) initial findings regarding abnormally low bids in public procurement. The report analyzes current measures and proposes new legal frameworks to enhance competition and mitigate risks associated with unreliable suppliers. The Konkurrensverket suggests that existing regulations, including LOU, LUF, and LUFS, are inadequate in preventing unfair competition and potential criminal activities.

Separately, Bloomberg.com reported that First Brands Group, a supplier of aftermarket auto parts, filed for bankruptcy. The filing, which occurred the Sunday preceding the article's publication, stemmed from the company's reliance on several billion dollars in short-term invoice-based and working capital financing. Despite these arrangements not significantly increasing balance sheet debt, their substantial scale and lack of transparency reportedly contributed to the company's financial distress.

First Brands Group's bankruptcy exposes creditors to billions of dollars in potential losses and raises concerns about inadequate financial disclosure in invoice-based lending. The situation also highlights broader issues regarding the financialization of corporate capital structures and the thoroughness of creditor due diligence processes.

Related Topics

public procurementbankruptcyregulatory changesinvoice financingcompetitionfinancial disclosureKonkurrensverketFirst Brands Group

Never miss stories like this